Personal finance can be a tricky beast to tame. You know you should save more, invest wisely, and reduce your debts, but somehow, intentions don’t always turn into actions. In this article, we are laser-focused on cracking the code of personal finance intentions vs actions. Ready to turn your good intentions into concrete results? Let’s dive in!

Personal Finance Intentions vs Actions

The Intention-Action Gap

Ever started the year with a resolution to save more but ended up splurging on things you didn’t really need? You’re not alone! Many people set stellar financial intentions like saving for a dream vacation or investing for retirement but end up nowhere close to that. How does this happen? Often it’s due to a lack of follow-through and maybe a pinch of procrastination.

Psychological Barriers

What’s blocking you from turning intentions into actions? It’s mostly in your head! Procrastination, emotional spending, and even poor motivation can create a huge roadblock. And let’s not forget cognitive biases, like confirmation bias where we only see the information we want. It’s like having a built-in excuse maker for not taking action!

Behavioral Finance Insights

Behavioral finance gives you a peek into the why of your financial decisions. Even with the best intentions, people make sub-par choices because of habits and automatic behaviors that are hard to shake off. The environment you’re in plays a significant role too. If everyone around you is spending a ton, it’s hard to be the only one saving, right?

The Physics of Personal Finance

Understanding Financial Momentum

Once you get going in the right direction, financial momentum can carry you forward like a snowball down a hill. It’s about those small, steady actions—your very own financial inertia! Picture a train slowly gearing up to speed. Start small, let habits build, and boom, you’re on track to success!

Leveraging Systems Over Goals

Goals are great, but systems are where the magic happens! Systems automate your financial tasks, making it easier to bridge the gap without even thinking about it. Want to save regularly? Set an auto-debit into your savings account. It’s like autopilot for your finances!

Strategies to Bridge the Gap

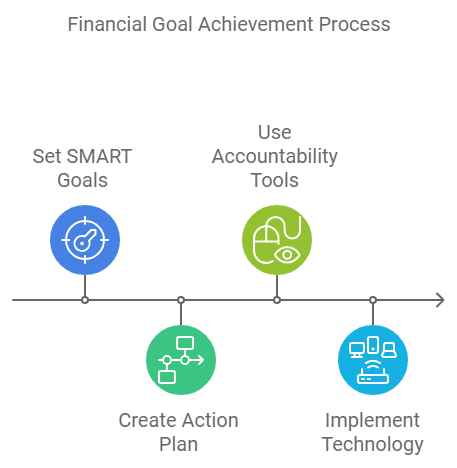

Setting Realistic and Specific Goals

Set goals that are SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. Don’t just say you’ll save; say you’ll save $200 every month for a vacation by next summer. Smaller steps lead to huge wins!

Creating an Action Plan

Now, put pen to paper. Or fingers to keyboard! An action plan is your road map. Consider having an accountability partner or using a budgeting app to keep you on track. Bonuses: You’re less likely to stray!

Using Technology and Automation

Welcome to the world of fintech! Apps like Mint or YNAB can automate your savings and track your spending so you won’t need to stress about your finances 24/7. Let the tech do the heavy lifting!

Case Studies and Success Stories

Real-Life Examples of Success

Meet Jane. She started by putting aside small amounts weekly using an app, and over time, she not only saved for a car but paid off her student loan. Her secret sauce? Consistency and fintech tools that required minimal effort. If Jane can do it, so can you!

Conclusion

In personal finance, the intention-action gap is the dragon to slay. Align your goals with systems, leverage technology, and you’ll be on the path to financial well-being. So, start today—because the best time to turn intentions into actions is now!

Additional Resources

Check out these links for more awesome tips on managing your money: NerdWallet, Bankrate. These resources will guide you further on your financial journey!

Leave a Reply