Hey there! Ever heard of Stoic philosophy? It’s all about living a balanced life by focusing on what truly matters. Sounds pretty cool, right? You might be wondering how this ancient wisdom is relevant to modern personal finance. Well, integrating Stoic principles into your financial life can lead to smarter money management and a calmer approach to handling your dough. In this article, we’re diving into some super cool Stoic tips to help you gain financial mastery. Ready? Let’s roll!

Understanding Stoic Philosophy in Personal Finance

Core Principles of Stoicism

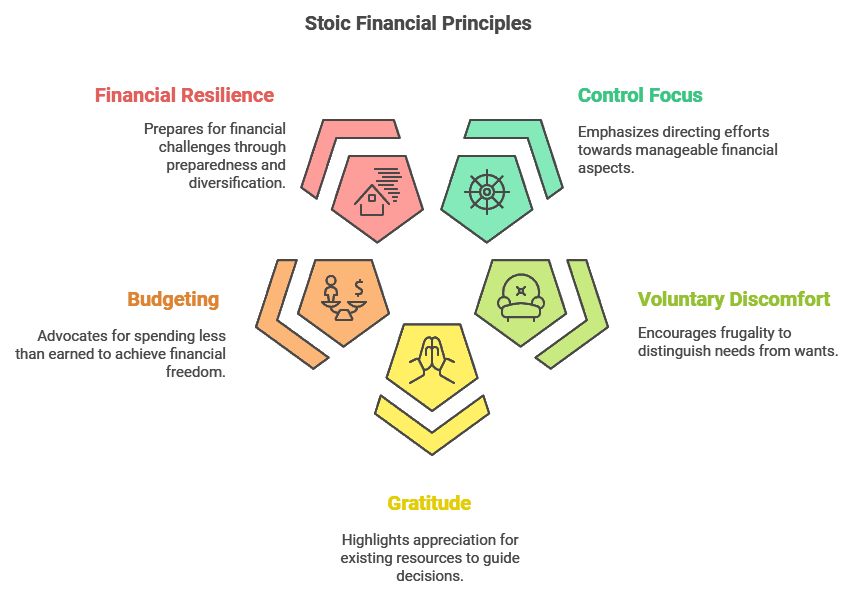

So, what’s the deal with Stoicism? It’s all about focusing on what you can control, embracing voluntary discomfort, and cultivating gratitude. Boom! Applying these principles to your finances can make a world of difference. Imagine being able to keep calm during financial storms or living simply by choice. Intrigued yet? Keep reading to find out more!

Why Stoicism Works for Personal Finance

Real talk: Stoic practices have helped many folks manage their money like pros. By adopting a Stoic mindset, you can slash financial anxiety and boost your savings. How awesome is that? Imagine feeling at ease with your money choices, knowing you’re making smart moves every step of the way. Let’s dive deeper into how you can make this happen.

1. Focus on What You Can Control

Identifying Controllable Aspects of Your Finances

First things first: let’s focus on what you can control. Sounds simple, right? Whether it’s your savings rate, spending habits, or financial education, this is where the magic happens. So, go ahead and channel your energy towards these areas for maximum impact. Remember, it’s all about what you can do, not what’s beyond your reach. You got this!

2. Practice Voluntary Discomfort

The Benefits of Living Frugally

Ever tried living frugally for a bit? This Stoic practice called voluntary discomfort challenges you to live on a tight budget. It helps you figure out the difference between what you really need and what’s just nice to have. Plus, it builds resilience and gratitude. It’s like a workout for your wallet, and trust me, the results are worth it!

3. Cultivate Gratitude and Contentment

The Role of Gratitude in Financial Decisions

Gratitude is a game-changer, folks. It’s all about appreciating what you’ve already got. And guess what? It’ll guide your financial decisions too! Simple practices like journaling about your financial blessings can help you stay grounded. You’ll be amazed at how acknowledging your resources can influence your money choices for the better.

Key Facts and Stats

- Financial Control: Studies show that individuals who focus on controllable financial aspects, like budgeting and saving, tend to make better financial decisions. They save more, incur less debt, and are more proactive in managing their finances1.

- Frugality and Voluntary Discomfort: Practicing frugality can lead to significant savings. For example, reducing unnecessary expenses can help build an emergency fund, which is crucial for financial resilience13.

- Long-Term Focus: Adopting a long-term perspective in financial planning is linked to better financial outcomes. This approach encourages saving for retirement and making investment decisions based on long-term benefits rather than short-term gains24.

- Emotional Regulation: Stoicism emphasizes rational decision-making over emotional reactions. This approach can reduce impulsive spending and improve investment strategies by focusing on logic rather than market fluctuations25.

- Emergency Preparedness: Building an emergency fund is a key aspect of financial resilience. Financial experts recommend saving three to six months of living expenses to safeguard against unexpected economic shocks34.

- Minimalism: Embracing financial minimalism by reducing unnecessary expenses can lead to greater contentment and financial stability. This involves focusing on essential purchases aligned with personal values4.

4. Live Below Your Means

The Importance of Budgeting and Saving

Living simply is a Stoic virtue that totally rocks when it comes to finances. Spending less than you earn is key to financial freedom. So, why not create a budget that prioritizes saving and investing over splurging? It’s about leading a lifestyle that’s not just sustainable but also rewarding in the long run. Let’s make it happen!

5. Invest in Self-Improvement

Enhancing Your Financial Knowledge

Keeping those learning gears turning is essential! Whether it’s through books, podcasts, or workshops, expanding your financial knowledge is a must. The more you know, the more confident you’ll feel in handling your money. So go on, explore those resources, and watch your financial acumen skyrocket!

6. Prepare for Financial Adversity

Building Financial Resilience

Life’s full of surprises, right? Preparation is your best friend when facing financial adversity. Think building an emergency fund, diversifying your investments, and getting adequate insurance coverage. These steps ensure you’re ready to tackle whatever comes your way. Let’s build that financial resilience together!

7. Practice Emotional Regulation

Making Rational Financial Decisions

Emotions can run wild, especially around money. But mastering them is crucial for smart decisions. Try taking a “freeze moment” before making big financial choices. And don’t hesitate to seek objective advice. Staying level-headed can be your superpower in the world of personal finance!

8. Practice Delayed Gratification

The 30-Day Rule for Non-Essential Purchases

Ever heard of the 30-day rule? It’s a tried-and-true method for practicing delayed gratification. For those tempting, non-essential buys, just wait for 30 days before committing. Visualize your long-term financial goals, and see the magic of holding off impulsive decisions. Your future self will thank you!

9. Give Back Mindfully

The Value of Charitable Giving

Giving back is key to Stoicism. Aligning your charitable donations with your values brings immense joy and purpose. So why not set aside some of your income for causes close to your heart? It adds meaning to your financial pursuits and spreads positivity all around. Go ahead, make a difference!

Conclusion

Wow, we covered a lot, didn’t we? From focusing on what you can control to practicing delayed gratification, these Stoic personal finance tips are here to transform the way you manage money. By integrating these principles into your routines, you’ll unlock long-term benefits that will lead to financial peace of mind. Ready to put these into action? Let’s do it!

Additional Resources

Looking for more? Check out these awesome resources to deep dive into Stoic philosophy and personal finance:

- Books: “The Obstacle Is the Way” by Ryan Holiday

- Podcasts: “The Tim Ferriss Show” for insights and inspiration

- Websites: Join r/stoicism on Reddit for community support

Leave a Reply