Personal finance education is essential, folks! A recent FICO study revealed that a whopping 60% of Americans see personal finance as one of the most valuable subjects in high school. Curious about the benefits? Keep reading as we dive into the nitty-gritty of how personal finance education can spark financial wellness and stability.

The Need for Personal Finance Education

Current Financial Literacy Gap

Let’s be real: the financial literacy gap is wide! FICO’s study found that a staggering 98% of folks are eager to learn about personal finance, as it’s key to financial stability. That’s right—financial know-how isn’t just a ‘nice-to-have’; it’s a must!

Generational Differences in Financial Literacy

Gen Z, this one’s for you! Did you know that 28% of Gen Z feels they lack financial literacy? Compare that to 20% of millennials and just 10% of baby boomers. Looks like there’s work to be done across the board!

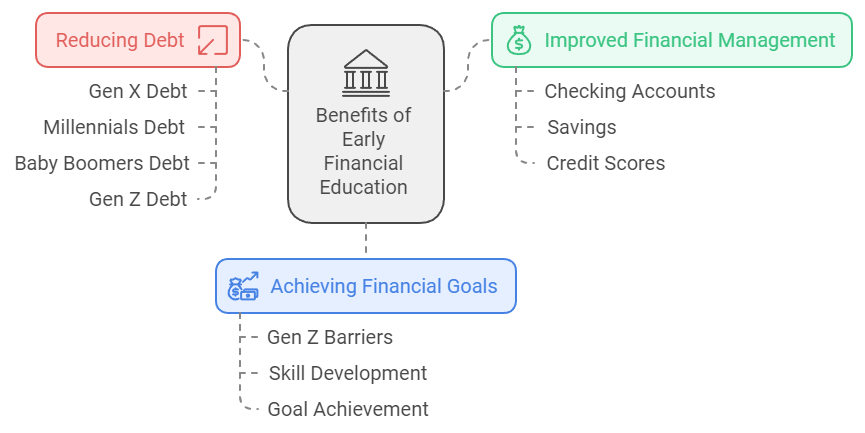

Benefits of Early Financial Education

Improved Financial Management

Learning about personal finance early can be a game-changer. Imagine mastering checking accounts, savings, and credit scores all by high school. That’s next-level adulting right there!

Achieving Financial Goals

For Gen Z, lacking personal finance skills has been a barrier. A quarter of Gen Z adults say it’s kept them from hitting their financial goals in the past year. Time to level up those skills and crush those goals!

Reducing Debt

A good grasp of financial literacy can help dodge the debt bullet. Check out these debt stats: Gen X struggles with $157,556, Millennials with $125,047, Baby Boomers with $94,880, and Gen Z with $29,820. More knowledge = less debt!

Current Educational Landscape and Future Trends

Existing Educational Shortfalls

Heads up: only 46% of Americans received personal finance instruction in high school. That’s a huge gap! But don’t worry, things are changing.

Increasing Mandates for Financial Education

There’s hope on the horizon—35 states now require a personal finance course for graduation, with a dozen hopping on board since 2022. Talk about progress!

Potential Impact on Future Financial Stability

Better Financial Decisions

Equip yourself with financial smarts early, and you’re set for better decisions, less debt, and a brighter financial future. It’s like having a superpower!

Economic Benefits

A financially literate population isn’t just good for individuals—it’s an economic game-changer. Imagine reduced financial anxiety and pumped-up financial stability. Boom!

Conclusion

So there you have it! Personal finance education isn’t just important—it’s life-changing. Schools must keep pushing to build this into curricula for everyone’s sake. Let’s gear up for empowering future generations with solid financial skills. You’ve got this!

Leave a Reply